nh transfer tax calculator

Click Here to Search. If you make 70000 a year.

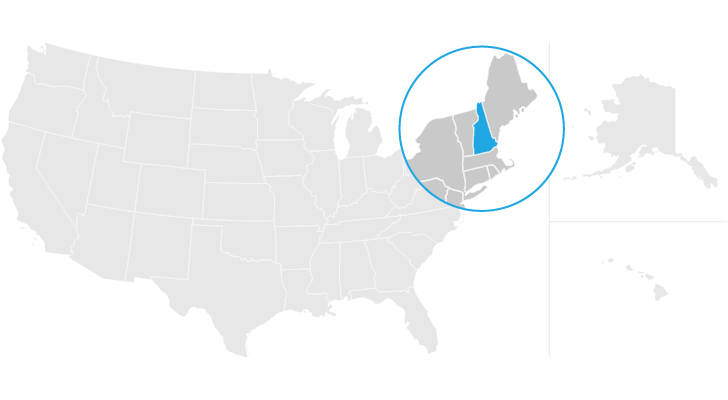

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Select PUD if property is in a Homeowers Association.

. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. Does New Hampshire have a mortgage excise or recordation. The assessed value multiplied by the tax rate equals the annual.

This tax is only paid on income from these sources that is 2400. New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street Medical Surgical Building Concord NH 603 230-5000 TDD Access. You will report the bonus as wages on line 1 of tax form 1040.

Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. The New Hampshire real estate transfer tax is 075 per 100 of the full price of or consideration for the real estate purchases. 4500 2 2250.

The result is the tax bill for the year. Chapter 17 Laws of 1999 increased the permanent tax rate assessed on the sale granting and transfer of real estate and any interest in real estate to 75 per 100 or fractional part thereof. New Hampshire Does Not Have A.

Monday Friday 800 AM 400 PM. Another option is to put more of your paycheck into an HSA or FSA if your employer offers it. The 2021 real estate tax rate for the Town of Stratham NH is 1852 per 1000 of your propertys assessed value.

Delaware DE Transfer Tax. For example if your assessed value is 100000 and your tax rate is 10000 you will pay 10000 in property. And while New Hampshire doesnt collect income taxes you can still save on federal taxes.

New Hampshire Income Tax Calculator 2021. 300000 x 015 4500 transfer tax total. The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules Rev.

The State of Delaware transfer tax rate is 250. Your average tax rate is 1198 and your. The RETT is a tax on the sale granting and transfer of real property or an interest in real property.

New Hampshire Salary Tax Calculator for the Tax Year 202223 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202223. May vary by property location please contact office for amount. 14 Main Street 2nd Floor Newport NH 03773 Phone.

The tax is imposed on both the buyer and the seller at the rate of 75 per 100 of the price or consideration for the sale granting or transfer. An original Form PA-34 Inventory of Property Transfer aka Real Estate Transfer Questionnaire must be filed with the Department within 30 days from the recording of the deed. From to transfer tax tax2 4001 4100 62 31 4101 4200 63 32 4201 4300 65 33 4301 4400 66.

A copy of the. Transfer tax and city tax calculator. While New Hampshire does not tax your salary and wages there is a 5 tax on income earned from interest and dividends.

Homebuyer Tax Credit New Hampshire Housing

New Hampshire Income Tax Nh State Tax Calculator Community Tax

The Ultimate Guide To New Hampshire Real Estate Taxes

Water Usage Calculator Town Of Exeter New Hampshire Official Website

New Hampshire Estate Tax Everything You Need To Know Smartasset

Dmv Fees By State Usa Manual Car Registration Calculator

Trash Talk The Brookline Transfer Station

How Much Money Do You Really Need To Buy A Home In Nh

Transfer Tax Calculator 2022 For All 50 States

Sales Taxes In The United States Wikipedia

New Hampshire Cost Segregation Source Advisors

New Hampshire Mortgage Closing Cost Calculator Mintrates Com

Resources Nh Barristers Title Closing Services

Resources Nh Barristers Title Closing Services

New Hampshire Income Tax Calculator Smartasset

Lowest Highest Taxed States H R Block Blog